Indicators on Whole Life Insurance Louisville You Should Know

Senior Whole Life Insurance - An Overview

Table of ContentsCancer Life Insurance Fundamentals ExplainedA Biased View of Kentucky Farm BureauNot known Facts About Whole Life InsuranceIndicators on Kentucky Farm Bureau You Need To KnowLife Insurance Can Be Fun For AnyoneGetting The Life Insurance Quote Online To WorkExcitement About Life InsuranceThe Greatest Guide To Life Insurance Companies Near MeThe Of Life Insurance Quote Online

The franchise agreement calls for that he directly contract for "all essential insurance coverage" for the successful procedure of the franchise business. He anticipates to have twelve workers, five full-time and also seven part-time (the shipment people), at his location, which will get on a hectic boulevard in Lubbock and also will offer take-out only.What type of insurance will be "essential"?. American Income Life.

Not known Details About Senior Whole Life Insurance

There are various kinds of Market wellness insurance plans designed to fulfill various needs. Some kinds of strategies restrict your company options or encourage you to get care from the strategy's network of physicians, healthcare facilities, pharmacies, and various other clinical company. Others pay a greater share of costs for service providers outside the strategy's network.

Some instances of strategy kinds you'll locate in the Marketplace: A handled care strategy where services are covered only if you use physicians, specialists, or hospitals in the strategy's network (except in an emergency situation). A type of health and wellness insurance coverage plan that normally limits insurance coverage to care from doctors that work for or agreement with the HMO.

American Income Life for Dummies

An HMO might require you to live or function in its solution area to be qualified for coverage. HMOs commonly provide integrated treatment as well as concentrate on avoidance and wellness. A kind of strategy where you pay much less if you utilize physicians, health centers, and also various other health and wellness treatment companies that come from the strategy's network.

A sort of health insurance where you pay less if you use carriers in the plan's network. You can use physicians, health centers, and also companies beyond the network without a recommendation for an extra expense. Get much more information on what you should recognize regarding carrier networks (PDF) - Term life insurance Louisville. See our Oral insurance coverage in the Market page to read more concerning choices offered to you.

The Best Guide To Life Insurance

There are many insurance policy alternatives, and also numerous economic professionals will state you require to have them all. It can be difficult to identify what insurance policy you actually require.

Variables such as youngsters, age, way of life, as well as work benefits play a duty when you're building your insurance policy portfolio. There are, nevertheless, 4 kinds of insurance coverage that the majority of economists advise most of us have: life, health and wellness, automobile, as well as long-term disability. American Income Life. 4 Types Of Insurance Everyone Needs Life insurance policy The best advantages of life insurance policy include the ability to cover your funeral costs as well as offer those you leave.

The Ultimate Guide To Life Insurance Louisville Ky

Sector experts suggest a life insurance coverage policy that covers 10 times your annual earnings. That's a number not every person can manage.

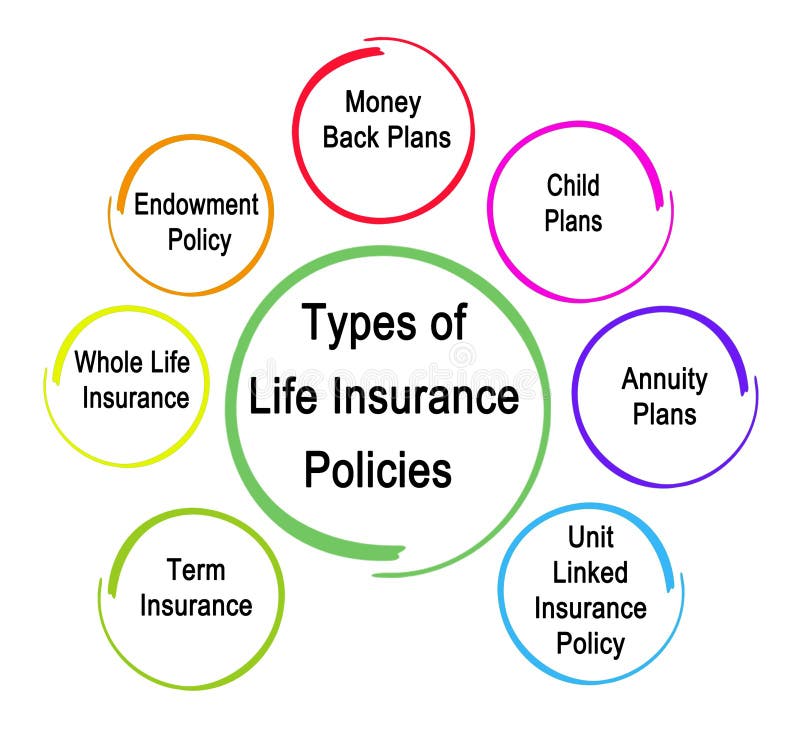

Both fundamental types of life insurance policy are typical whole life and term life. Just clarified, whole life can be utilized as an earnings device as well as an insurance tool. As long as you proceed to pay the monthly premiums, whole life covers you till you die. this hyperlink Term life, on the other hand, is a policy that covers you for a set amount of time.

Some Ideas on Life Insurance Company You Should Know

But with climbing co-payments, increased deductibles, and dropped insurance coverages, health and wellness insurance coverage has come to be a deluxe less and also fewer people can manage. When you think about that the nationwide average expense for one day in the hospital was $2,517 in 2018, also a minimal plan is far better than none. The ideal and least costly alternative may be joining your employer's insurance policy program, however several smaller services do not use this advantage.

How Term Life Insurance Louisville can Save You Time, Stress, and Money.

If you do not have medical insurance with a company, get in touch with profession organizations or organizations concerning feasible group health coverage. If that's not an alternative, you'll require to get private wellness insurance. Long-Term Impairment Coverage Lasting handicap insurance is the one sort of insurance coverage many of us think we will certainly never need.

Often, even those employees who have great medical insurance, a good nest egg, as well as a good life insurance coverage policy do not prepare for the day when they could not be able to benefit weeks, months, or ever before again. While health insurance policy pays for hospitalization and also medical costs, you're still entrusted to those day-to-day costs that your income normally covers.

The Best Strategy To Use For Child Whole Life Insurance

The expense of disability insurance coverage is based on numerous variables, including age, way of living, as well as health and wellness. Lots of plans need a three-month waiting period before protection kicks in, offer an optimum of three years' well worth of coverage, as well as have some significant plan exclusions.

The Of Life Insurance Louisville Ky

7 million car accidents in the U.S. in 2018, according to the National Freeway Website Traffic Security Administration. Life insurance. An estimated 38,800 people passed away in auto accident in 2019 alone. The leading reason of death for Americans in between the ages of 5 and 24 was auto mishaps, according to 2018 CDC data.